Exactly how much it is possible to borrow with a personal loan is dependent mostly on the credit card debt-to-cash flow ratio, and that is the amount of your respective every month income goes to paying out ongoing obligations like your rent, car payment, or bank card costs. Many lenders also have least credit score specifications for credit history approval.

The articles on this webpage is accurate as on the posting/final updated day; even so, a number of the charges described could have adjusted. We endorse traveling to the lender's Site for by far the most up-to-day facts accessible.

We're pledged for the letter and spirit of U.S. coverage for your achievement of equal housing opportunity all over the Nation.

Santander Bank, N.A presents an array of financial goods, which include own loans. If you’re needing speedy funding, Santander can be a good selection — determined by your application, your loan funds might be available the exact same day you apply.

Even now, a 72-month auto loan may be best if the lessen every month payments unencumber some cash to pay down greater-interest credit card debt in other places more quickly.

Prior to implementing for just a $sixty,000 personalized loan, you need to compile all the mandatory paperwork and information. Usually, you might need the next paperwork to use with any lender:

With just a couple clicks, you could possibly obtain up to 5 particular loan delivers from lenders on LendingTree’s personal loan marketplace. Evaluating a number of loan delivers prior to signing on the dotted line can help you save money in curiosity and charges.

Homeowners insurance policy guideHome coverage ratesHome insurance plan quotesBest property insurance plan companiesHome insurance insurance policies and coverageHome insurance plan calculatorHome insurance policies critiques

Upgrading your property is usually pricey, but Navy Federal Credit rating Union‘s prolonged a hundred and eighty-month loan phrase could help you distribute out your payments on a house advancement loan.

Pre-qualify. Several online, bank and credit history union lenders assist you to pre-qualify for a private loan. You give the lender some information about your self, such as your identify, profits, sought after loan amount of money and loan goal, as well as the lender will do a soft credit rating Examine to determine what loan sum, level and repayment term you may qualify for. Pre-qualify with many lenders to find the most effective offer.

Information about your latest and former employers, which include names and get in touch with information and facts for supervisors and HR

When purchasing your lengthy-term loan, think of how much time you need to tackle extra credit card debt. A longer loan expression may signify decreased regular payments, more info however , you’ll wind up spending extra fascination eventually. It’s clever to pick the shortest expression you may easily afford to pay for.

Your regular payment is not just a percentage of what you borrowed: Additionally, it contains the curiosity. To receive an even better notion of simply how much your payments will likely be, learn how to calculate your loan interest.

It locks you inside a contract: Loans lock you right into a payment plan for your established timeframe. When you might be able to shell out it off previously, You may have to pay a prepayment penalty charge.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Ross Bagley Then & Now!

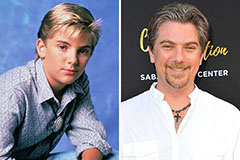

Ross Bagley Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!